Each year, millions of people make New Year’s resolutions. While the start of a new year traditionally gives positive beginning or jumpstart to many and an opportunity to identify new goals or plans to eliminate old negative habits, the stress and fatigue associated with the pandemic has impacted how we approach life, relationships and perhaps even our resolutions.

The latest Global Consumer Report (GCS) by Remark, a SCOR Group company, gives powerful insights into the changing attitudes of American consumers driven by the pandemic. Life insurers and insurance ecosystem players may want to integrate these valuable insights from the report into their marketing and product strategies. Below are key trends identified by the study:

- Americans want to learn more about life insurance.

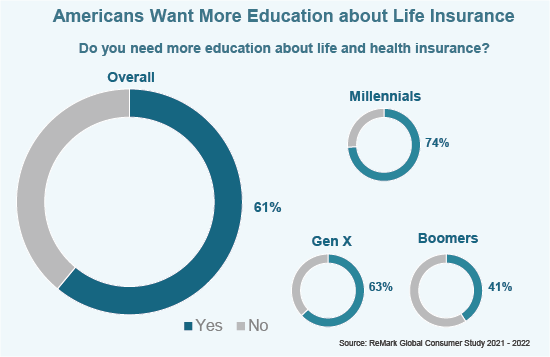

Don’t be surprised seeing the word “life insurance” in people’s New Year’s resolutions list this year. Americans’ interest in life insurance has greatly increased in the past couple of years, mainly driven by COVID-19. 61% of the surveyed U.S. respondents say they need more education about life and health insurance. That is especially high among Millennials.

One in three say COVID-19 has changed their attitude to risk and the value of insurance. That is more significant among those who knew someone who died from COVID-19 (70%). According to ReMark’s insurance literacy score, the U.S. ranked 11th among the 22 countries surveyed. Americans want to learn more about life insurance, but their insurance literacy lags behind other advanced countries like Canada, Sweden, the UK and Singapore. It is the U.S. life insurance industry’s opportunity as well as responsibility to raise American consumers’ life insurance literacy.

- Many have bought or increased life insurance coverage. More to follow?

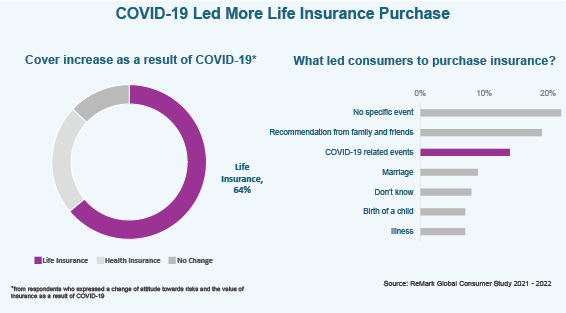

According to the GCS report, 64% of survey respondents say they increased their life insurance coverage in 2021.

Approximately half say they recently bought a new product, especially whole life policies. When asked what led them to purchase, 19% cite recommendation from family and friends and 14% say it was due to COVID- related events. It is uncertain if more Americans will follow this trend in 2022. But it is very likely that as the COVID-19 crisis continues, so does people’s need to ensure adequate insurance protection. It is up to each insurer to take advantage of this positive trend and actualize their potential customers’ desire to get more insurance protection.

- Americans want to exercise and sleep better. Life insurers want the same for us.

The report suggests 7 out of 10 survey respondents say the pandemic made them more proactive about their health. When asked what aspect of health they want to improve, “better sleep” has become the fastest-growing goal, ranked #2 after “more exercise.”

Wearable health devices, which track many health-related activities including steps, calories and sleeping patterns, are growing in popularity. Interest in ownership of wearables for health purpose has increased from 27% to 32% in two years. This is good news for life insurers, as healthier policyholders will bring better risk profiles and overall positive financial outcomes.

Some insurers are already taking an active role in integrating HealthTech into their insurance customer journey value chain, from product development and underwriting to inforce management. This trend is expected to continue as more ecosystem players including startups, vendors and incumbent players are joining this field.

New Year’s resolutions for insurers: Empower and educate consumers

This year, we suggest life insurers make their own New Year’s resolutions. Amid the rising interest and sales of life insurance among American consumers, life insurers have immense opportunities and challenges ahead, including the ongoing insurance protection gap.

Every insurer’s list should include action items aiming to empower consumers to improve their life insurance literacy. Companies with visionaries and innovative consumer-focused approaches will gain a competitive edge - and a leading industry position for years to come.