What actions should a pricing actuary take when a mortality study is deemed less than fully credible? Recall from Part 2 of this series that the number of claims used to define “fully credible” varies widely from company to company.

However, one thing holds true: the fewer the deaths, the less likely the study can be relied upon in predicting future mortality. But how much weight should the actuary then place on limited experience? This question falls under the topic of partial credibility.

“Partial” Credibility

In classic credibility theory, an experience study can be given “partial” credibility and weighted with another known and fully credible data source. This essentially places more weight on relevant prior knowledge until the studied block develops enough of its own specific claims experience. The more credible our information becomes on the particular lives under review, the less we rely on other sources.

The weighting formula makes use of the credibility measure (1 /square root of [# claims]) that we determined earlier in Part 1 of this series with the calculation:

Credibility Weight = Ö [(# of actual claims) / (# of claims needed for full credibility)]

We use this weight to combine our current study with the other data source:

Weighted Assumption = (Credibility Weight) x (experience study mortality) + (1 – Credibility Weight) x

(other source mortality)

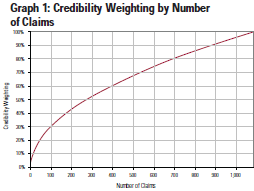

As the number of claims in a study approaches our definition of full credibility, more weight will be given to our study results. Let’s take an example where a company has determined that 1,082 claims are needed for full credibility. In other words, the company is comfortable knowing that future mortality will be within plus or minus five percent of the fully credible current experience mean 90 percent of the time. Graph 1 shows how the credibility weighting varies by claim count.

Sources of Fully Credible Data

Of course, all of this discussion about partial credibility assumes that we actually have an additional source of relevant fully credible data. In reality, actuaries are hard pressed to find other experience studies that accurately represent the future experience of the product they are pricing. If such was the case, they might as well use that proxy as their assumption and eliminate the whole credibility discussion.

Nevertheless, let’s investigate the pros and cons of alternative data sources.

Inter-company industry tables.

A typical Society of Actuaries Intercompany Study uses thousands of claims in determining mortality trends. While this gives an excellent and highly reliable view of historical industry experience, certain key characteristics of the contributing companies may not adequately represent the business under review. Differences to consider are product type, retail market, underwriting methodology, distribution channel, etc.

Other company experience. A pricing actuary may have access to mortality results from a larger block of business that is known to have characteristics similar to the current experience being analyzed. That block may be used as the fully credible component in our weighting formula, but the actuary should be aware of the number of claims in the block’s experience. The number of claims needed for full credibility should be adjusted to match that of the block and the weighting formula modified accordingly.

However, it is important to be aware of the consequence of making this adjustment. For example, the number of claims in the block may only be sufficient to make the statement that future mortality will be within plus or minus 20 percent of the experience mean 85 percent of the time. Understand that accepting fewer claims in the definition of “full” is tantamount to increasing the company’s tolerance for uncertainty.

Reinsurance experience. The company maintains a large experience database that allows us to create detailed studies on different slices of our business. We have tagged the data with company, product, market, underwriting, sales and other codes, enabling us to examine mortality trends within meaningful groups. Thus we can achieve high credibility (i.e., a large number of claims) while being confident that the trends relate to risks having a similar profile. When faced with a client’s less-than-fully-credible experience study, we can often use our highly credible grouped data to calculate a credibility weighted mortality assumption.

Series Conclusion

Experience studies provide the pricing actuary with an invaluable source of data for determining appropriate mortality assumptions. However, one needs to be aware of a study’s inherent limitations when presented with only a handful of claims.

Within this series of articles, I have demonstrated a theory that actuaries can use to assess mortality study credibility. More importantly, it provides a consistent context by which the actuary can articulate the financial consequences of using historical experience as the basis for predicting future outcomes.