Life insurers have long struggled to engage new customers and stay connected to existing ones. Faced with these challenges, it’s no surprise that health and wellness programs are emerging as a promising new approach to customer engagement. They are a natural extension of life insurance, with a win-win value proposition: policyholders live longer, healthier lives and insurers improve their business performance.

While we see innovation in all areas of life insurance, activity in wellness platforms is a fast-emerging disruptor within the life insurance industry. One reason is that Insurtech start-ups are keen to break into the life insurance market, and they see big potential in wellness platforms. These new entrants – far from being competitors – are partnering with carriers to help transform the industry.

With today’s technological capabilities, the integration of life insurance and wellness services is both feasible and inevitable – and welcomed.

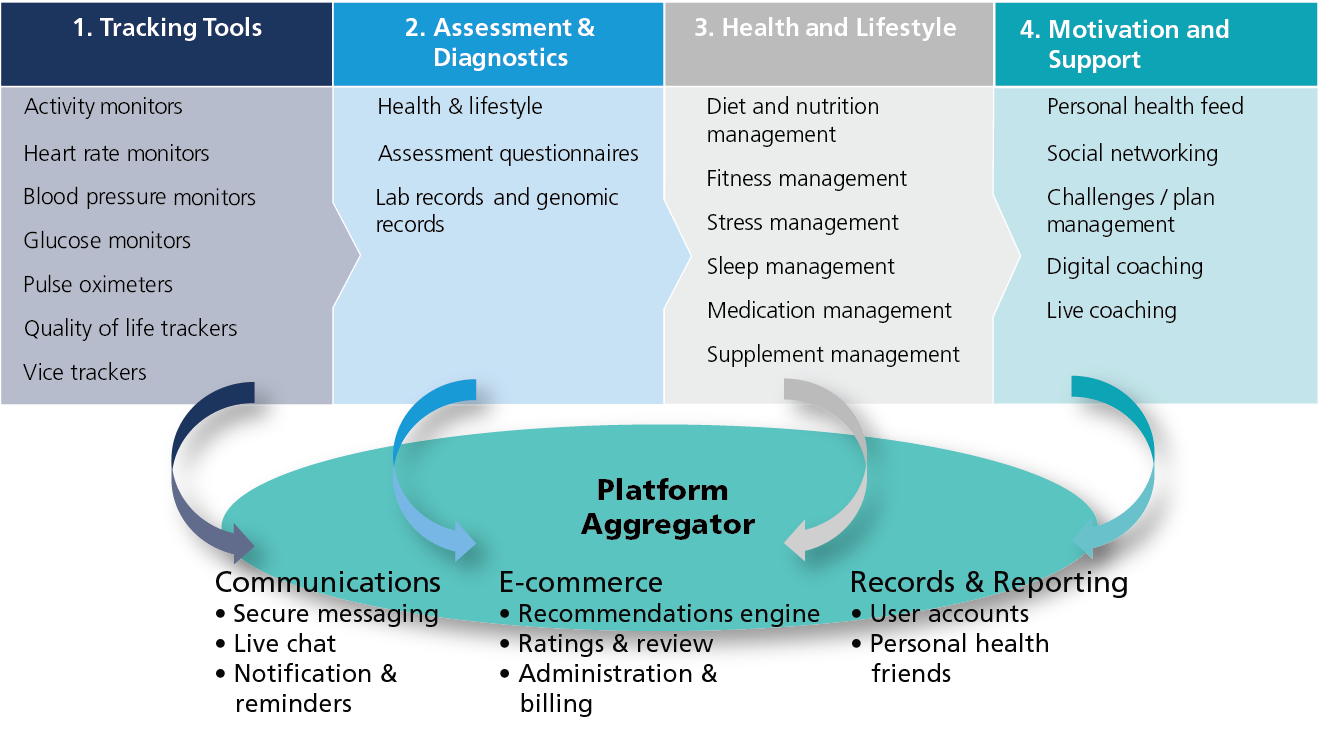

Figure 1 - Components of Wellness Platforms

Click on image to display in larger size

Launched and Piloted Programs

We’ve already seen a few insurers launch wellness programs aimed at attracting and retaining new customers. An emerging trend involves pilot programs aimed at inforce policyholders. These programs employ a variety of approaches including personalized

health coaching, rewards, incentives and progress reporting. The common goal is to keep customers engaged in the programs to the point where their behavior has a positive impact on their health. This is also the biggest challenge as it is much easier to engage individuals up front than to keep them engaged over the long term.

Wellness programs may involve wearable technology where the policyholder gets a wearable device in exchange for allowing the carrier monitor data captured from the device. Data on individuals may include heart rate, activity, sleep and blood oxygen levels

Other programs are app-based where individuals self-report. Either way, the policyholder sets goals and earns credits that can be redeemed for gift cards or other rewards. In Europe, there are some wellness programs that are designed to reduce or include

a rebate toward future life insurance premiums for insureds who demonstrate activities that align to a healthier lifestyle. But this design still faces regulatory hurdles in the US.

Wellness programs deliver a steady stream of actionable data points that insurers can use to interact in a positive way with their customers throughout the duration of a policy. This ongoing interaction can lead to a stronger, trust-based relationship between the policyholder and insurer. It has the potential to change the image of life insurers in the eyes of consumers to be a company that cares about their overall well-being as well as the financial security of their heirs.

From a mortality management perspective, wellness platforms offer rich potential for carriers to develop a better understanding of how health conditions and lifestyle habits affect mortality. SCOR’s R&D team is currently working with a client on a protective value

study to establish what impact wearables can have on an inforce block of business. Analysis of data from wearable devices has the potential to lead to more accurate pricing and underwriting as well as innovation in product design.

Everybody Wants to Be Healthy

The wellness phenomenon in the life insurance arena is driven largely by the fact that there is a ready market for it. Research conducted by ReMark, a SCOR affiliate, shows that a focus on health and wellness presents an opportunity for growth. A preoccupation with health is shared by all generations.

ReMark research shows that the priority consumers place on health is attitudinal rather than chronological: 30% of Boomers, 33% of Gen X and 32% of Millennials all cite health issues as a motivation for future policy purchase. Clearly, health matters across the

generations. This begs the question: Could the reimagining of life insurance combined with a health and wellness offering lead the way to renewed growth and a brighter future for the industry?

Reinsurers on Board

As a global leader in life reinsurance, SCOR is actively participating in the health and wellness movement. It recently launched SCOR Life & Health Ventures to pursue targeted strategic partnerships and investments in companies that can bring a complementary offering to our clients.

- One venture involves an

investment in and partnership with iBeat, a San Francisco-based health and wellness company that created the iBeat Heart Watch. This cellular smartwatch tracks the wearer’s heart rate 24/7, can detect oncoming

cardiac arrest and engages an expanded emergency response network to shorten the time it takes for help to arrive. We are currently launching a pilot program involving the iBeat Heart Watch with clients.

- SCOR also is working with a genetic sequencing firm that is an innovator in providing data-driven health intelligence to a broader range of people. The health profile they work up is a health plan to help prevent, reduce or postpone the onset of certain conditions with the goal of improving life expectancy of the 50+ cohort by 5-10 years. Similar to the iBeat pilot, piloting this program is geared toward improving the health of in force policyholders.

- In Asia, SCOR launched a Biological Age Model that identifies applicants whose biological age is lower than their actual age. Built in partnership with several companies, it assesses mortality risk using continuous data provided by wearable

devices. The goal of the initiative is to increase the number of life insurance products that offer discounts and other benefits to customers who are likely to have more favorable mortality.

SCOR is also an “Anchor Partner” in Plug and Play, a US-based accelerator for tech start-ups. Through this partnership, SCOR gains access to world-class technology start-ups along with an early preview of emerging technology innovations. It is an effective

and efficient way for us to broaden and deepen our know-how in technology-driven solutions and strengthen our commitment to disruptive innovation.

Through these and other ventures, we aim to further support our clients in developing innovative solutions to help achieve their growth and strategic objectives.