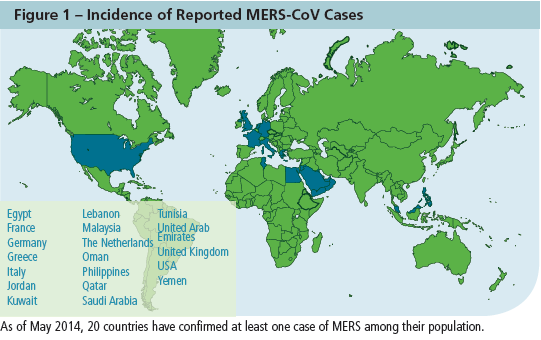

Pandemic risk is the largest tail risk for many insurers and reinsurers. My colleague, Doris Azarcon, and I have been studying this risk extensively over the past five years. In early May the Centers for Disease Control reported the first confirmed case of Middle East Respiratory Syndrome-Coronavirus (MERS-CoV) in the United States, joining at least 19 other countries reporting cases (Figure 1). At least one additional case has now been reported in the US. First discovered in Saudia Arabia in 2012, MERS-CoV severely disrupts respiratory functions, leading to pneumonia, shortness of breath, coughing, and fever. Based on recent World Health Organization data, about 40 percent of reported cases have resulted in death.

While prevalence remains statistically negligible (571 reported cases globally as of May 2014) incidence has increased noticeably since the beginning of the year (www.who.int/mediacentre/multimedia/mers-transcript.pdf?ua=1). Moreover, the presence of the virus reminds risk managers of the many challenges in monitoring, managing and mitigating the effects of highly contagious diseases. While just a handful of individuals currently may exhibit symptoms, we do not know how many others latently carry the virus.

The US typically has demonstrated resiliency to severe infectious disease. If we examine the US insured population as a subset of the general population we find that pandemic effects are even less pronounced. Many factors may help explain this phenomenon (such as those listed under “Prevention” in Figure 2).

|

Figure 2 – Factors that Mitigate/Promote Pandemics |

|

Prevention |

Enablement |

|

Medical Advances |

Global Travel |

|

Real-Time Communication |

Increased Drug Resistance |

|

Stronger Global Collaboration of Resources |

Inconsistency in Medical Intervention Availability |

|

|

Population Density |

In today's world, advances in medicine, technology and human interaction are a double-edged sword. While technology has improved our response time to emerging infectious outbreaks, it has also facilitated the spread of contagion.

Understanding the Risk

As part of an effective enterprise risk & return management (ERRM) process, we must consider the catastrophic effects a pandemic may have on not only the population in general but the insured population in particular. Several factors come into play.

A Life Insurer’s Product Portfolio. Pandemics pose significant risk for mortality and morbidity coverage. The mortality component is fairly cut and dried: a virulent pandemic has the risk of killing many afflicted insureds, leading to excessive mortality claims.

However, depending on the severity and persistency of a pandemic, morbidity claims originating from costly and chronic medical interventions may affect cash flow much more quickly and severely. Individuals diagnosed with a pandemic illness may survive in ICU-like environments for relatively long durations at considerable cost. The population-wide nature of the pandemic can create strain on supplies available to properly treat patients, raising costs even more.

Perhaps the greatest risk for life insurers occurs when a life insurer covers both the mortality and the morbidity risk on a group of lives, especially if these lives are concentrated in a specific region. The insurer risks paying excessive claims on medical expenses related to treating the infection (as well as any related complications, such as pneumonia), in addition to death benefits.

Certain other risks may also be aggravated. We should expect higher-than-planned disability and long-term care claims in debilitating pandemics. Carriers have addressed these concerns somewhat by offering accelerated benefit riders, where the living benefit (chronic illness or long-term care) is a portion of the death benefit. Cash flow implications should also be considered, however.

Longevity Risk Components. Annuity and retirement products can help hedge some of this risk. A carrier with a diversified risk portfolio (morbidity, mortality, longevity) may have more success in managing a spike in claims arising from a pandemic.

Risk Classification. Companies that establish and adhere to strict preferred underwriting guidelines may manage their losses more effectively than other carriers. Preferred underwriting involves in-depth review of an applicant’s individual health and personal and family history to eliminate those risk factors that present higher probabilities of dying.

While pandemics are generally indiscriminate in their infection of individuals, we would expect that, under identical conditions, someone who exhibits preferred-class mortality and morbidity should have a much higher chance of not only surviving the disease but also recovering more quickly to full health.

It is important that life insurers develop and maintain appropriate selection criteria and implement controls to ensure strict adherence to their risk classification guidelines. “Tainting the pool” through stretch criteria or table shaves can create unexpected volatility in mortality and morbidity experience. Alternatively, the insurer should properly compensate for its marketing strategy. Companies that allow flexibility in their preferred classes, or that target market segments that typically fall outside of preferred, must factor this strategy into their pricing.

Capital Effects

Regulatory regimes and ratings agencies continue to modernize how companies determine appropriate risk-based capital levels. Past “turn the crank” formulaic approaches are gradually giving way to more dynamic principles-based modeling. Internally, many companies already calculate recommended capital targets based upon their views on enterprise-wide risk, incorporating the entire range of risks to which companies are exposed (Figure 3). A key component to many capital models, however, is estimating catastrophic or tail risk. Pandemics can be the top catastrophic risk to a life insurer – and the industry.

|

Figure 3 - Enterprise Risks |

|

•

Product Risk (Mortality, Longevity, Morbidity) |

|

•

Consumer Risk (Selection, Lapse) |

|

|

•

Strategic Risk (including Catastrophic Risk) |

|

•

Operational Risk |

|

|

|

•

Investment/Interest-Rate Risk |

|

|

•

Market Risk |

|

|

|

|

•

Regulatory Risk |

|

|

|

Enterprise-wide risks comprises risks that develop both inside and outside the organization.

Tools to Mitigate Pandemic Risk

The life insurance industry, in conjunction with other financial services companies, has developed a number of solutions to help individual companies manage their exposure to pandemics and other catastrophic risks. Swaps, the exchange of one asset (or liability) for another of equal expected value (loss), have been used effectively in helping life insurers manage both mortality and longevity risk.

Other insurers have issued contingent-triggered bonds to manage mortality, morbidity and catastrophic risk. Contingent capital structures provide carriers with access to capital in the event of a variety of situations. Each of these financial structures carries varying costs and basis risk.

Alternatively, reinsurance may be an effective risk and capital management tool that may eliminate basis risk and usually ties the interests of the company assuming the risk to those of the ceding company.

A Commitment to Understanding and Managing Pandemic Risk

As a global organization, SCOR monitors pandemic risk as a key consideration in our ERRM process. SCOR has sponsored global forums where academicians, epidemiologists, industry experts and other stakeholders can come together to discuss looming challenges and best practices. Our team of pandemic analysts around the world consult frequently with each other on events in their respective regions and any implications they may have to progress from outbreak to pandemic. We continuously and conservatively model potential pandemic outcomes to our block of business.

As a result of this diligence, SCOR has entered several financial transactions, such as the Atlas IX mortality bond, to manage pandemic and other catastrophic risk for the benefit of ourselves and ultimately our clients. If you would like to learn more about SCOR’s approach to pandemic risk or to enterprise risk & return management in general or receive literature that our experts have produced on these topics, please feel free to contact us.